Friday, December 28, 2012

Gold looking bad

Gold looking really. Stochastics losing power. MACD still pointing down. Big waterfall is coming few days later.

Wednesday, December 26, 2012

Sunday, December 23, 2012

Gold downtrend

Gold downtrend not finished yet. You can clearly see the monthly MACD there's still falling. There's more room left for gold's downmove.

Thursday, December 20, 2012

Wednesday, December 19, 2012

Tuesday, December 18, 2012

US dollar index

On monthly chart it's looking really bad. Most likely dropping to 75 level. Silver and gold is nicely recovering but I'm not convinced yet. It's still pointing down on weekly indicators.

Monday, December 17, 2012

Metals running down

Friday, December 14, 2012

Silver gets beaten.

Gold is holding well but silver gets beaten brutally. JP Morgan hates silver so much. Next week we will see 31.50 silver.

Thursday, December 13, 2012

Ben Bernanke speaks

Tuesday, December 11, 2012

FOMC meeting

If today Bernanke announces more money printing the metals price will surge dramatically.

Today' gold price

Looks like big take down is coming. Possible levels are 1660 and 1630. They are preparing big surprise for us.

Saturday, December 8, 2012

The other day I was in the local mall booking my flight outa here when I spotted a woman at a 'We-Buy-Gold' counter in the middle of the place. I sidled up and asked what she paid for a one ounce KR.''R13000'' she said,''but only if it's in good condition, no scratches. ''

What if it is scratched I said. ''Then it will be R11000 or so.''

So they knock the buy price on numismatic grounds.Clueless fools.

R13000=$1501.15. R11000=$1270.71. Spot KR =$1753+- today.

I reckon there are about 4 days of buying opportunity,though I have no fiat at present to spend. Benny boy 12 TH Dec,may be HEH. ;O)) BWTFDIK

GETTING DOWN TO THE DIRTY ON PROFITS

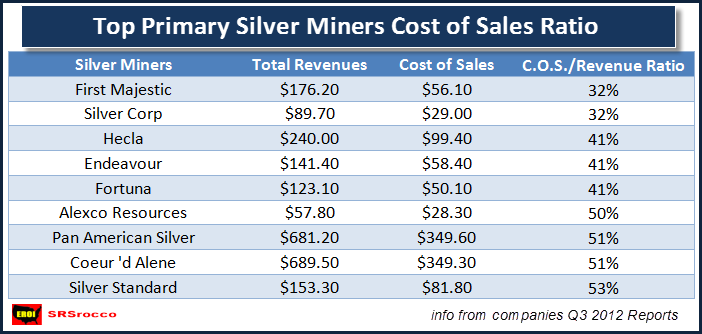

A few days ago, I presented this table on the top silver miners COST OF SALES ratio (figures are in millions...also the table represents the first nine months of 2012):

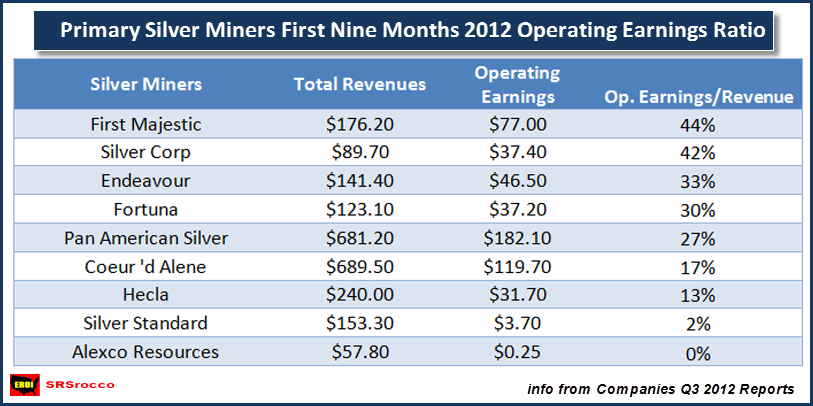

I have put together another one showing the OPERATING EARNINGS (figures are in millions):

This chart was listed by highest to lowest in OPERATING EARNINGS. Here we can see a change in the structure when we add this further aspect. For clarity, cost of sales are costs, and operating earnings are actual gains. The cost of sales only includes the actual mining costs at the mine. To get to the operating earnings, we have to take out depreciation, depletion, amortization, general & admin, exploration, share based costs and etc.

Operating Earnings do not include either gains or losses on derivatives, any mine sales, or taxes. That is the problem with Net Income... it may include gains on the company selling a mine or etc. This may be nice on their balance sheet, but it skews their performance in mining silver that quarter or year.

However, we see how some of the miners fell down the list as we include OPERATING EARNINGS. The four miners on the bottom all stated net income losses in Q3 2012, except Alexco... it had a mine sale of $6.3 million which boosted its net income to positive from negative.

According to my data, the top 2 in both tables, First Majestic & SilverCorp have the best low cost structure of the bunch. They also showed the highest net income percentage compared to the others. Here is the breakdown:

Q3 2012 Net Income (for last three months only)

First Majestic = $24.8 million (2.1 million oz silver produced)

Pan American Silver = $22.6 million (6.3 million oz silver produced)

SilverCorp = $13.5 million (1.3 million oz silver produced)

The interesting thing to note is that First Majestic made more net income than Pan American and produced three times less silver.

Anyhow, I am putting this all this data together on spreadsheets that will be put on my future website. My wife tells me I need to charge a fee for the detailed data or else she will kill me for spending so much time on the damn computer.

I've had a similar experience. A couple of weeks ago, I was at the dance studio where my kids take ballet, and one of the other dads came over and told me that he was looking at getting a home defense shotgun, and had "heard" that I have a gun or two (or more - don't tell Mrs. Hang10). He asked about getting some basic firearms training, entry level gun safes and the best local ranges. I asked him if this was the first time he'd considered arming himself, and he said "yes." I asked what the motivation was, and he said "I'm not really sure, but I'd just be more conformable being able to handle things myself - if it comes to that."

I didn't pursue what "things" he thought might come up, or what he meant by "handling things" himself.

I also asked how he'd heard that I have a few guns, and it turns out that my daughter was telling the other ballerinas that she prefers daddy's AR15 over the Ruger 10/22, but that the Mossberg semi-auto is "the loudest and most fun."

That's my girl!

I'll hit the other dad up about PM's, and if he's not yet in the club, I'll invite him to Turdville :-)

Do you want fries with that .... that'll be $999 at the first window ? I was a little hard on CL and Daystar .... and I like them both .... and they contribute more than I do to this forum ! Just remember .... people who honestly put people into PMs are doing the Lord's work .... and their kids don't get their School Loans forgiven .... like Congressmen's kids ! Monedas 1929 Comedy Jihad And Baiting And Switching Is How We Catch Fish World Tour

I've heard it, too. People next to me in checkout lines talking guns or metals, and someone I haven't seen in a while brings it up out of the blue during lunch. People I work with talking about going to the range. It's all over the place. More gun/ammo talk than metals talk, I've noticed. One local gun club used to be wide open for anyone to join as of 2 years ago. Now it's closed to new members and there's a waiting list.

How to Spot Good & Bad Analysis

As most of you know, there isn't a shortage of precious metal analysis on the internet. Everyone has their opinion. Yes, even I. However, there is a way to understand which analysis is better than the other.

To be able to find out which analysis offers the most accuracy, it must get to the root of the problem. Unfortunately, most analysts do not try to get to the root of the problem, instead they use data taken from other sources and make their predictions and forecasts based on this spoon fed data.

For example, all the nitwit politicians and their economists keep regurgitating about how to CREATE JOBS. This is by far the most insane analysis I know of. The U.S. has peaked in creating net new jobs and its all downhill from here. Now, there is a way of creating millions of new jobs overnight.... get rid of the computer. If we did that... then by gosh we will create more jobs than there are U.S. citizens. However, I assure you, this is not something the government will do.

ORE GRADE DECLINES....WHAT'S THAT?

Several years ago, I sent a chart to several well known precious metal analysts on the decline of gold ore grades in 4 countries over the past one hundred years. I only received a few responses, but two of them asked me where I got that chart and was it true. This was circa 2008.

At that time, I saw no gold or silver analyst write or talk about falling ore grades. However, today, a week doesn't go by without someone in this field bringing up this subject. Hell, even if you go on King World News, you will hear it from some of the top folks.

This is the very reason why I have taken the time to look at how the ore grades and yields are declining in the top gold and silver producers. I know of only a few individuals who have provided actual data on the decline in gold ore grades and yields, but no one has done this in silver. That is why I researched and produced the chart below (from my previous guest post):

I am not mentioning this again to toot my own horn (my wife does that for me), but to show that of all the precious metal analysts I have come across, no one has yet presented any information on actual data of declining silver ore grades. So... how in the living hell can any precious metal analyst really make a correct forecast if they don't have the ROOT FUNDAMENTAL DATA???

I focus more of my attention on the analysts who are cheerleading the miners without knowing the energy situation in the future. Again, how can they get on King World News or where ever for that matter, and state that the miners are a good place to park ones money when they don't have a grasp on the aspects of energy and declining ore grades?

Of course these miners can still produce metal for the foreseeable future, but what happens in say 5-10 years when the energy situation grows increasingly worse? What happens to all those so-called ASSETS (plant, equipment, trucks and etc) when energy shortages appear? I mean, how does an accountant figure what these assets are worth, if there isn't enough energy to run them? This is HUGE PROBLEM no one is looking at. The same king of thing that no one was looking at 4 years ago in declining ore grades.

MY PROBLEM WITH BIX WEIR

I saw the interview with David Morgan and Bix a few days ago. Bix is a pretty intelligent chap who does understand the manipulation of the precious metals. However, his theory that the collapse of U.S. Debt will be the savior for the country because he believes we will tap into all these HIDDEN RESOURCES, makes his good analysis turn quite bad.

Even if a person doesn't believe in PEAK OIL, the falling EROI- energy returned on invested has been proven by actual data. I would like to remind the reader that our modern society needs at least an EROI of 8/1 to survive. Tar sands at 2-4/1 and shale oil at 4-5/1 will not help us in the end... even though it is bringing on more supply.

Bix, doesn't go to the ROOT OF THE PROBLEM. That is why his theory is full of holes.

BREAK-EVEN GOLD NOW AT $1,300+

I also saw that article by Paul Van Eeden about the fair price of gold to be $800-$900 an ounce. As I stated in a previous post... the man is completely FOS. (full of sh*t). If we look at the table I put together below, we can see that when we factor in ALL COSTS, the break-even price of gold is now above $1,300:

Here we can see that if we take the total net income of the top 5 gold miners Q3 2012, we get $1.9 billion or 39% less than the same quarter in 2011. If we take that net income and divide it by the total amount of gold produced by the group we get $348.65 net income profit per ounce.

Before I get any hate mail... I realize this is a simple way to get that calculation.. but it is at least a much better metric than the stupid industry's CASH COSTS. If we take the average price of gold currently, we can see that break-even is somewhere at $1,350 when we add in everything.

So, for Paul Van Eeden to state that the fair price of gold is in excess of $500 less than break-even, the top gold miners proves again that he is not only FOS, but did not go to the ROOT of the problem. I highly doubt the market would ever value gold at $800-$900 an ounce knowing that break even is now $1,350.

CONCLUSION

The biggest problem I see going forward is declining liquid energy supplies on the global market. Hardly no one (especially in the mining industry) is looking at this at all. That is why I believe most of them will get a rude awakening when they fail to realize their mining stock that has mines with 30 year mine lifespan may turn out to be a terrible investment in the future.

However, this makes owning physical metal even better....

All jobs are NOT equal. Public sector jobs are paid for with tax revenues. Not nearly as productive in an economic sense and private sector jobs.

(CNSNews.com) - Seventy-three percent of the new civilian jobs created in the United States over the last five months are in government, according to official data published by the Bureau of Labor Statistics.

In June, a total of 142,415,000 people were employed in the U.S, according to the BLS, including 19,938,000 who were employed by federal, state and local governments.

By November, according to data BLS released today, the total number of people employed had climbed to143,262,000, an overall increase of 847,000 in the six months since June.

In the same five-month period since June, the number of people employed by government increased by 621,000 to 20,559,000. These 621,000 new government jobs created in the last five months equal 73.3 percent of the 847,000 new jobs created overall.

I found this link at Drudge. Do you think this will be discussed on CNBS or The Nightly News???

I don't know how the BLS does it but they got it right again. It DOES look like lots of people got jobs this month. The Top 3 of the new jobs I've seen created in Southern California with my own eyes...

3) "Retail"- Oranges, flowers and peanut sales on freeway off-ramps have seen a rise in the last few months. Sales of "found" items through pawn shops also seem to be up.

2) "Administrative and Waste Services"- The number of random people spinning signs or waving flags for all kinds of services like check cashing, foreclosure services and Cash for Gold places is up.

1) "Hospitality and Leisure"- There has been a rise in people just hanging out. I see more people leisurely milling around at parks, on streets and road medians. They have nice cardboard signs spreading hospitable messages and asking for donations.

"The working-age population went from 243,983 to 244,174 (thousands), an increase of 191,000 working-age people. But the total number of employed people fell from 144,039 (thosuands) to 143,549, a loss of 490,000 actual employed people!

The spread is even worse, of course -- closer to 3/4 of a million workers, because you must account for the population increase as well."

So much for that actual unemployment number. Let the lies continue... I'm stacking no matter what.

I had thought that today's unemployment report would be more reflective of reality, what with the election behind us. I mean, with all the layoffs that have been announced since the election, the unemployment rates goes down? Sure. Okay. It seems that TPTB have other reasons, besides getting Obama re-elected, to make the economy appear to be in better shape than it is. And there are likely to be many more layoffs in the coming months due to the costs companies face with having to comply with Obamacare. I'm amazed at how long TPTB have been able to keep this house of cards from completely imploding. And I reckon they'll continue to astonish me for a little while longer. But I know that I'm right about the end result and the steps I've been taking to prepare for the death of the U.S. Dollar.

I have a bad feeling

We must be careful about this monthly chart. We already had big movement from 1523-1798. Nearly 300 dollar movement. The thing is monthly stochastic is already in overbought area. Monthly MACD is losing it's steam. We know they printing loads of money. It should be positive for gold price. But they're still controlling the paper market. So they can slam the paper price with those newly printed fiat. This is my suspicion. Month December might be down. So be careful if you're trading paper gold or silver.

Subscribe to:

Posts (Atom)